Monday March 16th… Dear Diary. The main purpose of this ongoing blog will be to track United States extreme or record temperatures related to climate change. Any reports I see of ETs will be listed below the main topic of the day. I’ll refer to extreme or record temperatures as ETs (not extraterrestrials).😉

Main Topic: Fanning the Flames: How Executives Continue To Be Rewarded To Produce More Oil And Gas At Odds With The Energy Transition

Dear Diary. As coronavirus continues to rage we also see reports of bad actors in association with the much longer term climate crisis. Here’s a question. Why as of 2020 would some be rewarded for pushing fossil fuels, particularly in light of increasingly clear science and overwhelming global warming evidence? Shouldn’t the opposite be true for energy companies such that leaders of those entities get paid more for big transitions to renewables? Unfortunately for most energy companies the opposite is true looking at this recent article from Carbon Tracker posted via Desdemona Despair. Take a look:

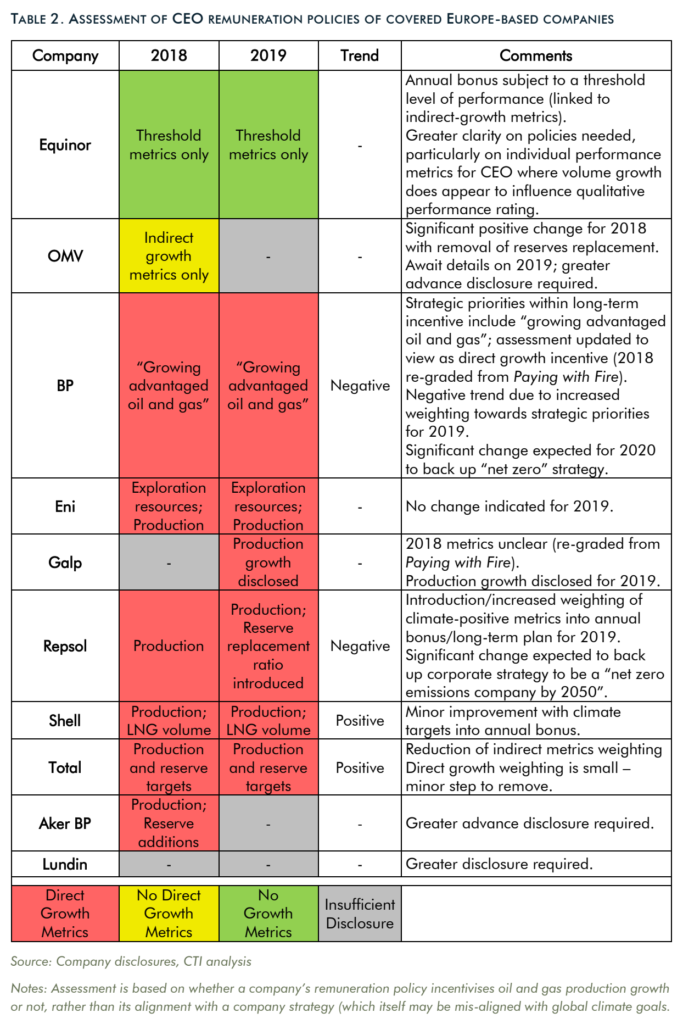

Assessment of CEO remuneration policies of Europe-based fossil fuel companies in 2020. Company pay practice doesn’t yet live up to climate ambition, with the gap between stated ambition and demonstrable action widening. Data: Company disclosures / CTI analysis. Graphic: Carbon Tracker Initiative

13 March 2020 (Carbon Tracker) – Company pay practice doesn’t yet live up to climate ambition, with the gap between stated ambition and demonstrable action widening.

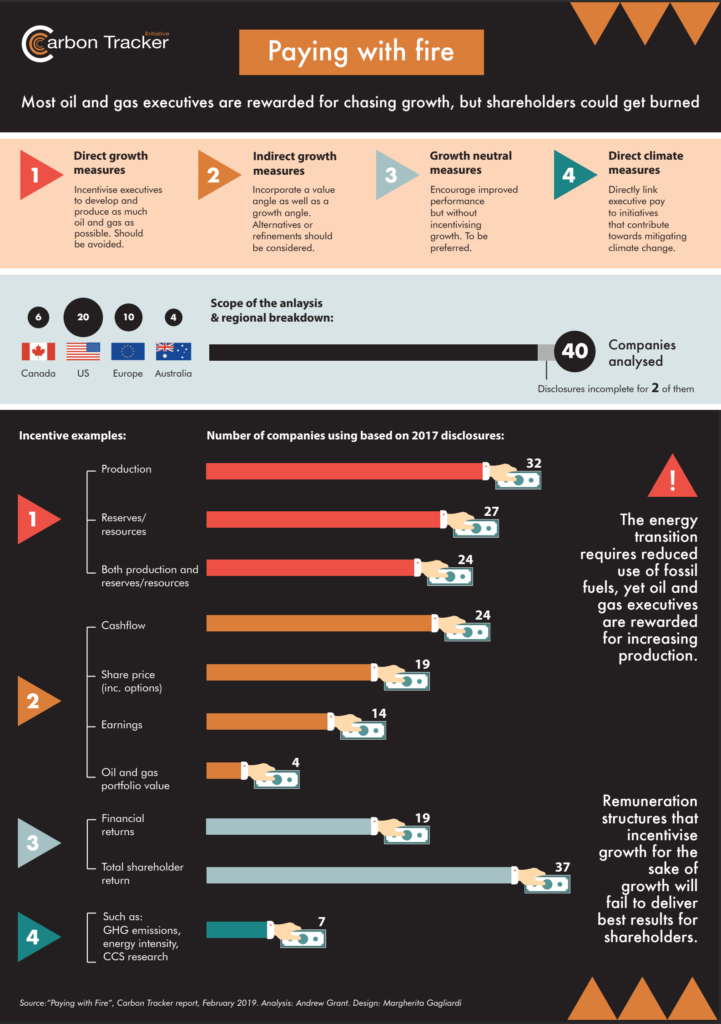

The energy transition is a challenge to the traditional business model of the oil and gas industry, and companies are increasingly exposed to transition-related financial risks.

Over the past few years a number of new corporate ambitions have been announced relating to carbon emissions reductions, however, there have been only minor, incremental changes in terms of remuneration policy.

2020 will be a key year for announcements

The window for society to react to climate change is rapidly diminishing, and with remuneration policies typically applying for a number of years once set, these need to reflect the realities and dynamism of the energy transition.

We would hope to see significant updates in remuneration policies at their respective 2020 AGMs, with the exclusion of any metrics which incentivize the growth of hydrocarbon production. We encourage investors to review these policies in detail and consider how they vote in response to those policies which reward management for volume growth rather than relative value creation.

Key findings

We review the remuneration policies of 30 of the largest listed oil and gas companies and find:

- 26 out of 30 companies have direct growth metrics such as production or reserves replacement metrics in their 2019 incentive structures, at odds with the value-focused strategies needed through the energy transition.

- Globally, 15% of variable pay is driven by direct volume growth metrics, with a third of variable pay linked to growth including more subtle indirect growth incentives.

- Just four companies have no direct growth metrics: Diamondback Energy, Equinor, OMV, and Origin Energy.

- For European majors, nearly half of variable pay incentivises growth (direct and indirect metrics).

- From those who disclose 2019 policies, we see limited progress from 2018. No companies have removed all of their direct growth metrics in the period. Galp Energia have increased transparency, but disclosed the use of a production growth metric.

- 2020 is a critical period – will newly announced strategies (e.g. Repsol and BP) be backed up with consistent remuneration policies?

- Disclosure could be improved in some cases, particularly for North American companies and smaller Europeans, focusing on precision of metrics and relative weightings.

Sigh. No one at this point should be rewarded for bad behavior, but it seems that big energy companies can’t help themselves. Again, as I keep repeating, a higher entity, big government, should police big energy. Hopefully later this decade we will see this in the U.S. after the 2020 election.

Now, here are some of todays articles on the coronavirus:

Please consider donating through the Paypal widget on this site. I need everyone’s support to continue my work, especially that of processing NCEI record count data for scientific research.

Here is some more weather and climate news from Sunday:

(As usual, this will be a fluid post in which more information gets added during the day as it crosses my radar, crediting all who have put it on-line. Items will be archived on this site for posterity.)

(If you like these posts and my work please contribute via the PayPal widget, which has recently been added to this site. Thanks in advance for any support.)

Guy Walton “The Climate Guy”